Professional Support: Bagley Risk Management Techniques

Professional Support: Bagley Risk Management Techniques

Blog Article

How Livestock Threat Defense (LRP) Insurance Policy Can Protect Your Animals Investment

In the realm of animals investments, mitigating threats is critical to ensuring financial security and development. Livestock Risk Protection (LRP) insurance stands as a reliable guard versus the uncertain nature of the marketplace, supplying a tactical method to guarding your assets. By diving into the ins and outs of LRP insurance coverage and its diverse advantages, livestock manufacturers can strengthen their financial investments with a layer of safety that goes beyond market fluctuations. As we discover the realm of LRP insurance policy, its function in safeguarding livestock investments becomes significantly evident, guaranteeing a path towards lasting monetary strength in an unpredictable sector.

Comprehending Livestock Risk Security (LRP) Insurance

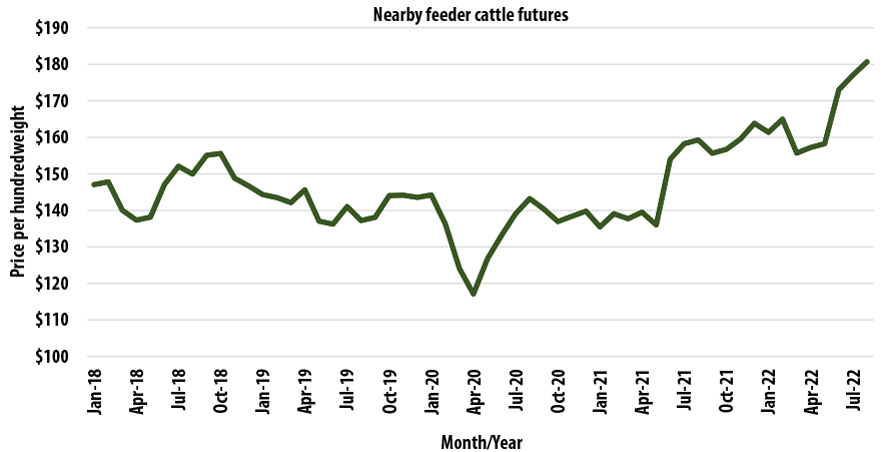

Recognizing Livestock Risk Defense (LRP) Insurance policy is essential for livestock manufacturers seeking to mitigate monetary dangers connected with price fluctuations. LRP is a federally subsidized insurance coverage product created to secure manufacturers against a decrease in market value. By providing protection for market value decreases, LRP helps manufacturers secure a flooring price for their animals, guaranteeing a minimal degree of profits no matter of market fluctuations.

One trick facet of LRP is its adaptability, enabling producers to customize coverage levels and plan sizes to fit their certain needs. Manufacturers can pick the number of head, weight array, coverage price, and coverage period that line up with their manufacturing objectives and run the risk of resistance. Recognizing these customizable alternatives is essential for manufacturers to efficiently handle their price risk direct exposure.

Moreover, LRP is available for numerous animals kinds, including cattle, swine, and lamb, making it a versatile risk management device for livestock manufacturers throughout different sectors. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, producers can make enlightened choices to safeguard their investments and make certain monetary stability when faced with market unpredictabilities

Benefits of LRP Insurance for Animals Producers

Livestock producers leveraging Livestock Threat Security (LRP) Insurance coverage obtain a strategic benefit in shielding their investments from price volatility and safeguarding a steady financial footing among market uncertainties. One crucial benefit of LRP Insurance policy is price security. By establishing a flooring on the rate of their animals, producers can reduce the threat of significant financial losses in the event of market declines. This permits them to plan their spending plans extra effectively and make informed choices about their procedures without the constant concern of rate variations.

In Addition, LRP Insurance policy supplies producers with tranquility of mind. Generally, the benefits of LRP Insurance policy for livestock manufacturers are considerable, using a useful tool for taking care of danger and guaranteeing monetary safety in an uncertain market environment.

Just How LRP Insurance Policy Mitigates Market Risks

Alleviating market dangers, Livestock Risk Protection (LRP) Insurance coverage offers livestock producers with a dependable guard versus cost volatility and financial unpredictabilities. By providing defense versus unforeseen rate drops, LRP Insurance assists manufacturers protect their financial investments and maintain financial security in the face of market fluctuations. This kind of insurance policy enables livestock manufacturers to secure in a cost for their animals at the start of the policy duration, making certain a minimal rate level despite market changes.

Actions to Protect Your Livestock Financial Investment With LRP

In the realm of farming threat management, carrying out Animals Threat Security (LRP) Insurance policy includes a critical procedure to guard financial investments against market fluctuations and uncertainties. To safeguard your animals financial investment efficiently with LRP, the very first step is to assess the particular dangers your procedure faces, such as rate volatility or unanticipated climate events. Understanding these dangers enables you to identify the protection degree needed to shield your financial investment adequately. Next off, it is critical to research study and pick a credible insurance coverage company that provides LRP plans tailored to your animals and organization needs. Very carefully evaluate the plan terms, problems, and protection restrictions to ensure they straighten with your danger monitoring goals once you have actually picked a supplier. Additionally, routinely monitoring market patterns and changing your insurance coverage as needed can aid optimize your security versus prospective losses. By adhering to these actions faithfully, you can boost the security of your animals financial investment and navigate market uncertainties with self-confidence.

Long-Term Financial Safety With LRP Insurance

Ensuring enduring monetary security through the use of Livestock Threat look at this now Security (LRP) Insurance coverage is a sensible long-term method for agricultural manufacturers. By integrating LRP Insurance policy right into their risk management strategies, farmers can protect their animals investments against unexpected market changes and unfavorable occasions that could threaten their financial well-being gradually.

One key advantage of LRP Insurance coverage for long-lasting economic protection is the assurance why not check here it offers. With a reliable insurance policy in position, farmers can minimize the economic threats related to volatile market problems and unexpected losses as a result of elements such as illness episodes or all-natural disasters - Bagley Risk Management. This security enables producers to concentrate on the everyday procedures of their animals business without consistent bother with possible monetary troubles

Moreover, LRP Insurance coverage supplies a structured strategy to managing risk over the long term. By setting specific coverage degrees and selecting ideal recommendation periods, farmers can tailor their insurance coverage intends to line up with their monetary goals and risk resistance, ensuring a safe and secure and sustainable future for their animals procedures. To conclude, spending in LRP Insurance coverage is a proactive approach for agricultural producers to accomplish lasting financial security and shield their incomes.

Final Thought

In verdict, Animals Threat Security (LRP) Insurance is a beneficial tool for livestock producers to minimize market dangers and safeguard their financial investments. It is a wise choice for securing animals investments.

Report this page